Recent changes in supply and demand are transforming the sapphire business, and prices for these gems have soared.

The stones are primarily mined in Sri Lanka (Ceylon), Myanmar (Burma), Tanzania, Madagascar, Kenya, Mozambique, Ethiopia, Australia, and the US state of Montana. “The finest blue sapphires currently come from Nigeria, Madagascar and Sri Lanka,” says Michael Arnstein of New York-based gem supplier The Natural Sapphire Company.

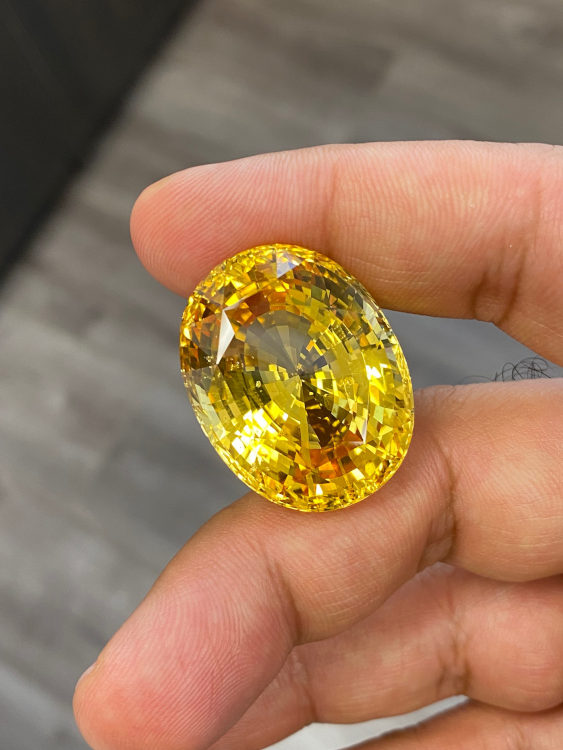

While sapphires are available in a kaleidoscope of hues, including sunset yellow, lavender, and rose pink, the most classic is the celestial blue. Rare Kashmir sapphires displaying a vivid, velvety blue unique to the region fetch the highest prices at auction, followed by those from Burma and Ceylon, says Benoît Repellin, acting worldwide head of jewelry at auction house Phillips. Prices have also increased for newer deposits like those in Madagascar. “Top-quality gems from Madagascar can have the appearance of a good-quality Kashmir or Burmese and also appear on the secondhand market,” he says.

Still, collectors primarily seek untreated sapphires with no indications of heating, and only afterward look at the stones’ origin, he adds. Armil Sammoon, in contrast, contends that there is specific demand for provenance, while heat treatment is a matter of taste. “Some parts of the European market favor unheated goods, while the US has no particular preference,” says the chairman of Sapphire Capital Group. He is also Sri Lanka’s ambassador to the International Colored Gemstone Association (ICA). Arnstein, for his part, has found that “about 50% of our customers want untreated sapphires; the other 50% are okay with heated sapphires.

Origin has little to no interest to most of our buyers.” Color seems to matter, though. “Blue sapphires remain 75% of our sales ratio to other colors,” he says. Dave Bindra sees the greatest demand for unheated sapphires of all colors from Sri Lanka and Madagascar. “We’ve seen a tremendous spike [in] pastel-colored stones of all types, especially for pastel blues,” reports the vice president of B&B Fine Gems in Los Angeles.

Clean padparadscha sapphires of good clarity, both heated and unheated, have become incredibly difficult to find in significant sizes, he adds, observing that these stones have registered “the highest spike in price due to incredible demand and supply-chain constraints worldwide.”

The price equation

Sapphire prices have risen approximately 25% since trade shows reopened this year after pandemic restrictions eased, Arnstein says. Part of the reason is that production has declined in the past few years, with no discoveries of major new sources since 2016, according to Thai trader Sith Jungsanguansith of World Sapphire Trading Co. Covid-19 mine closures have contributed to the decline in output, Arnstein adds. This means that as always, demand for sapphires is outstripping supply.

“Mines are producing fewer stones, so prices really went up for medium- to high-quality stones,” Jungsanguansith reports. An upsurge in the desire for colored gems in general is another factor in the price jumps, says Sammoon.

Arnstein cites a growing interest in sapphire for lower-cost engagement rings in emerging markets. “Sapphires are used primarily as alternatives to diamond engagement rings. The engagement market is recession- and pandemic-resistant; people fall in love in all market conditions,” he declares.

On a broader scale, he attributes the price hikes to money printing and expansionary monetary policy, which create boom-and-bust patterns in markets. “This has strengthened the wholesaler’s and also end consumer’s desire to invest more in hard assets.” Bindra concurs: “Lots of liquidity in the marketplace globally means that when fine material does become available, it is often acquired in a shorter period of time than we have seen pre-2020, due to the number of ready buyers.”

In the auction world, several factors could account for the soaring prices, according to Repellin. One is the origins on some gemological reports. “There’s a brand appeal for origins like Kashmir and Burmese,” even for lower-quality stones, he says. Another factor is the big-name jewelry houses that have focused on sapphires. “Graff, the famous London-based diamantaire, also launched magnificent pieces with extraordinary sapphires of impressive weights.”

Value judgements

Prices depend on many variables, including shape, color saturation, treatment, clarity and cut quality. Arnstein has found that 1-carat, heated sapphires with great color and reasonable cut quality retail for $500 to $800 per carat on average. Calibrated heated sapphires of up to 2 carats from any origin, with good color and luster, are always in demand, says Jungsanguansith, who works mainly with heated stones. “A 1-carat blue sapphire can range [from] $15 to $700 per carat, depending on quality and origin,” he estimates.

Blue sapphire cabochon hook earrings in 14-karat gold by Grace Lee. Photo: Grace Lee.

Prices in the past five years have outpaced those of the previous decade, continues Jungsanguansith, who has been in the sapphire business for 20 years. Sammoon estimates that fine-quality heated stones between 1 and 2 carats range from $500 to $1,500 per carat, while their unheated counterparts would go for $800 to $2,500. Fine sapphires of 3 to 5 carats are more difficult to source, so these larger stones go for $1,000 to $4,000 per carat for heated and $1,500 to $5,000 per carat for unheated, he says.

Struggles in Sri Lanka

Part of the issue is that production in Sri Lanka has slowed down. The country’s ongoing economic and political crisis has led to unprecedented inflation levels and a devaluation of the national currency. “Although the mines are facing a shortage of the diesel required to fuel their equipment, the industry has managed the challenges to the best of its ability,” Sammoon reports. “Foreign buyers have continued to visit the traders, and markets and export services remain functioning.”

Significant quantities of rough sapphires are smuggled into Sri Lanka from east African countries and Nigeria, according to Arnstein, who also points to “new mining locations that remain highly confidential and unknown in the market.” Rising sapphire production in Africa will continue to cover a large percentage of the market, he believes. “Origin is a very unreliable science — or opinion — and we don’t recommend [that] dealers or retail clients put much value on origin. We state where our sapphires come from in our listings, but this is not a guarantee.”

Staffing issues

Labor continues to be an issue. While mining continued throughout the pandemic, the restrictions and safety measures affected many lapidaries and manufacturers. “We saw a significant exodus of individuals moving to the agricultural sector during Covid-19, and producing countries are still facing these ripple effects,” relates Bindra.

In Sri Lanka, Samoon also witnessed a drop in the workforce during the pandemic as experienced employees retired from their jobs. “Those in the industry now have to employ and train an entirely new generation of workers in order to return to the previous production levels,” he says. Bindra adds that “the current and heartbreaking crisis in Sri Lanka has also created an entirely new set of challenges.”

As for the future, “short-term supply paranoia will likely continue through 2023,” predicts Arnstein. “Inflation will persist as long as oil remains high, and the idea of raising prices everywhere will unfortunately lead to a slowdown in trading. Dealers will eventually lower prices, and the market will contract.” He forecasts that the price decline will occur in the next five years.

“With automation and adoption of gemstones being listed on the internet, a lot of hidden inventory will work its way into the end-consumer marketplaces, driving up competition tremendously,” he adds. “Most dealers who are not very tech-savvy will find it extremely difficult to move their inventory in the future”.

New hues for ‘I do’s

In the post-pandemic era, colorful, unconventional and boldly bespoke engagement rings are gaining in popularity. Modern couples wishing to eschew classic styles are gravitating toward unusual colored sapphires in distinctive settings, shapes and arrangements.

“For engagement rings, there’s a rise in multi-stone sapphire rings in fancy shapes like pears, and fancy colors like pinks and purples,” comments jeweler Grace Lee, who specializes in wedding bands and heirloom reinventions.

Making the most out of sapphires’ extensive color palette, New York-based brand Brent Neale uses the gems in many of its pieces.

“Because of the variety of color and my love for all things rainbow, sapphires are one of my favorite stones,” says founder Brent Neale Winston.

With our increasingly busy lifestyles, sapphires in heavy gold bezel and gypsy settings are minimalist, ergonomic and discreet in style, and especially relevant today. Brent Neale’s Wildflower setting features individual gems in a flower formation, a refreshing take on the classic cluster ring.

“It’s a popular setting with brides, and we have also reset clients’ original engagement rings in this style,” says Winston. “It’s classic and feminine, appealing to a wide range of ages.”

The majority of brides still prefer to pair sapphires with diamonds in a three-stone style, she adds.

Jewelry brands like Retrouvaí put their own spin on sapphire engagement rings, opting for smooth, simple silhouettes with central stones arranged obliquely for a clean, modern look. Violet-blue, pale-green and pink sapphires appear in a variety of step and oval cuts.

“Our clients look for quality and unique stones,” says Retrouvaí founder and designer Kirsty Stone. “We have done heirloom bezel rings with a sapphire as engagement rings, which I love. The setting feels nostalgic but able to grow with its owner.”

Left image: Picchiotti earrings with 3.90 carats of sapphires and 8.26 carats of diamonds. Photo: Picchiotti.