Industry experts weigh in on the highs and lows of the ruby business amid macroeconomic challenges, with coloured gemstone dealers banking on stronger demand in emerging markets.

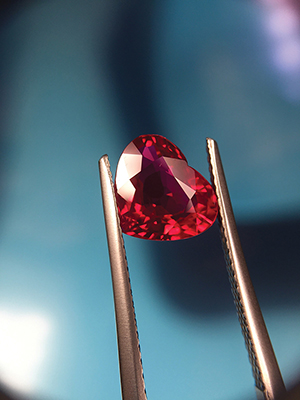

For many centuries, rubies have symbolised passion and power – their fiery colour prized by the kings and queens of Europe, the tzars of Russia and the shahs of the Mughal empire. These beloved stones continue to dazzle the jewellery market today.

Gems from the Mogok Valley in Myanmar are deemed to be the finest and most valuable, proven by top-performing rubies sold at international jewellery auctions. According to Gemburi Co Ltd Managing Director Phuket Khunaprapakorn, ruby deposits were discovered in a few regions mainly in Thailand and Myanmar around 40 to 50 years ago. Today, these deposits are exhausted.

Jeffery Bergman, founder and director of 8th Dimension Gems, explained that rubies from Mogok remain highly sought after, with larger and better-quality stones selling at prices twice to 10 times higher than their counterparts from other origins.

Over the past decade, however, Mozambique has emerged as the largest source of fine-quality rubies, changing the landscape of the global ruby trade. Fine stones can also be found in Madagascar, Vietnam, Tanzania, Tajikistan, Afghanistan and Greenland.

Khunaprapakorn said rough rubies from Madagascar are of medium to low quality, and largely set into more affordable jewellery. Greenland meanwhile produces both cabochon and facetted material, majority of which require heating and fracture filling with borax, according to Bergman.

Major markets for top-range rubies are the US, Europe and Asia while medium- to fine-quality stones are traded mostly in the US, Mainland China, Hong Kong, Japan and the Middle East. Demand for stones of lower quality typically comes from India.

Strong demand, tight supply

Veerasak Trirotanan, president of Thailand-based Veerasak Gems Co Ltd, revealed that premium-grade rubies enjoy stronger demand from buyers seeking one-of-a-kind gems. “With natural resources continually being depleted, fewer extraordinary rubies are discovered, resulting in supply shortage. On the other hand, commercial-grade rubies are common,” he noted.

Sales have recently dropped though due to widespread Covid-19 travel restrictions, continued Veerasak, adding that traders now mostly rely on digital images and virtual communication, “which cannot portray the complete characteristics of a gemstone, making inspection more difficult for buyers.”

Bergman noted that while demand for commercial-quality rubies softened in 2020, top-grade gems were still favoured as evidenced by the sale of a 6.41-carat Pigeon’s Blood Burmese ruby for US$2.8 million at Sotheby’s in Hong Kong.

Joe Belmont, founder and director of Thailand’s KV Gems, also attested to the continuous demand for fine, unheated rubies above 2 carats during the pandemic.

Phillips’ Worldwide Head of Jewellery Graeme Thompson explained that with increasing prices of high-quality stones, rubies have become a viable investment tool. Dmitry Zyubenkov, founder and director of Geveling Ltd, added that prices of rubies at auction increased 80-fold in the last 20 years while those of commercial goods did not go up as fast and remain dependent on jewellery trends.

According to Philippe Ressigeac, COO and co-founder of tech software company GemCloud, prices across all categories were stable pre-Covid-19. Medium- and commercial-quality rubies however face price uncertainties due to business disruptions.

The increase in prices of Burmese rubies meanwhile could be attributed to the higher volume of Mozambique goods in the market, disclosed Ressigeac.

He commented, “Once you get a product in volume flooding the market, retailers become interested and invest in marketing. You then have a fringe of buyers that request only the best from a certain product range. In this case, Burmese rubies are deemed the best.”

Thompson added that demand for alternative options like Mozambique rubies is on the rise, owing to the lack of Burmese goods in the market. Despite this growing trend, the market remains slow to embrace alternatives, so Burmese rubies remain highly desired.

“Mozambique rubies are relatively new – the mines were only discovered in 2009 – but already, we are seeing interest levels from serious collectors surpass that in Thai rubies, for instance,” he continued.

Zyubenkov agreed that Mozambique rubies are gaining steam in the commercial jewellery market, but this has no bearing on the price of exceptional Burmese rubies. He said, “If you compare a 5-carat Burmese ruby with a similarly sized unheated Mozambique stone, the Burmese gem will sell for seven to 10 times more. There is not much difference in price among commercial-quality calibrated stones.”

Business in a pandemic

Production at Gemfields’ Montepuez ruby mine in Mozambique was suspended during the pandemic, with only essential activities being done onsite. The priority is to resume mining operations as soon as possible.

According to Gemfields, more than 95 per cent of the world’s ruby production go through Chanthaburi and Bangkok for cutting and polishing, so the ruby business hinges on the competitiveness of the Thai market. Restrictions such as a 14-day quarantine for arrivals in Bangkok have lately been affecting business travels.

“Part of the purchasing process includes prospective buyers confirming the value of the product after closely inspecting the gemstones. This hasn’t been possible, with many travellers choosing not to go to Bangkok,” said Gemfields.

Tentative mine closures have also made it more difficult for traders to source new material. Belmont of KV Gems stated, “We haven’t been able to attend Gemfields’ auctions since December 2019 and we are unsure when the next auction will take place. The market outlook for fine-quality rubies will remain positive regardless as prices were unaffected by Covid-19.”

Li Chongjie, founder and managing director of coloured gemstone manufacturer China Stone Co Ltd, said his company has enough rough rubies for now, but it will eventually have to look for a solution. Chiku Sukhadia, managing director of Sukhadia Stones Co Ltd, warned that the business will take months to get back to normal even with the replenishment of raw materials.

Rubies are among Thailand’s top export products, generating over US$100 million in revenues a year. In 2019, the Gem and Jewelry Institute of Thailand or GIT established two new colour standards for ruby, namely “Rabbit’s Eye Red” and “Golden Red” to fill a gap in the ruby trade.

“We have received positive feedback from Japan, China, and the US but unfortunately, the pandemic has disrupted plans to promote these new standards to key markets,” said GIT Director Sumed Prasongpongchai.

GIT is planning to organise two events post-pandemic – the GIT International Conference 2021 in conjunction with the International Chanthaburi Gems and Jewelry Festival 2021 in Chanthaburi province.

Buyer sentiment

Rubies bearing the elusive Pigeon’s Blood colour are deemed the most valuable but Thompson of Phillips revealed that some collectors find this tone too dark while others prefer more transparency or a hint of a warmer, secondary colour. “One thing all clients agree on is that rubies must have up-to-date certificates from a reputable international laboratory,” he said.

Purchasing a ruby is an extremely personal experience due to each stone’s colour variation. Veerasak explained that rubies from different origins differ slightly but distinctively in tone, so preferences may vary depending on each customer.

Mining company Greenland Ruby, whose customer portfolio includes the US, Asia, northern Europe, Germany and the UK, said there is ample interest in rubies from the Asian market, with cabochons attracting great attention. Buyers also place a premium on colour and the enduring legacy of rubies, according to Hayley Henning, CCO of Greenland Ruby.

Demand for ruby had been steadily increasing before the pandemic due to inadequate supply in the market, particularly in China. With the economic slowdown in Europe and the US, Khunaprapakorn said the Chinese market has focused its attention on ruby jewellery. He noted, “Chinese traders were attending industry exhibitions to source loose rubies for jewellery production. They also travelled to Thailand and Chanthaburi to buy and sell rubies on platforms like WeChat.”

According to Veerasak, China is a major source of growth, with strong demand for rare and high-quality rubies pushing prices up. Prices of commercial-quality rubies remained stable as supply meets market demand.

“Chinese buyers are driving prices up especially for Pigeon’s Blood rubies from Burma,” he remarked. “Demand in India is on the rise, buoyed by an increasing number of middle-class consumers with discretionary funds. Rubies are also often featured in traditional Indian bridal jewellery.”

Demand for fine-quality stones are steady in Taiwan, Japan and Singapore while Indonesian buyers mostly go for large quantities of commercial-grade goods.

Zyubenkov of Geveling Ltd reiterated this sentiment, saying that Chinese, Japanese, Thai and Singaporean customers are ruby experts and are willing to invest heavily in quality stones.

Belmont of KV Gems said American and Chinese buyers prefer deeper shades of red while those in Europe are partial to more “open” colours. “The US market is more accepting of heat treatment but China and Europe are not. As such, global demand for untreated goods has grown significantly over the past years,” he said.

China Stone’s Chongjie also underscored the Chinese market’s relentless appetite for rubies, adding that clients looking for high clarity prefer goods from Africa while those opting for “open” colours would choose Burmese rubies.

He said China Stone will increase production of its precision-cut rubies in 2021 and aggressively promote single-stone rubies of more than 2 carats.

Prospects

Rubies remain a perennial favourite among jewellery traders and collectors, thanks to their formidable status in the realm of gemstones.

Despite macroeconomic challenges, the ruby sector is poised to grow even more, especially in emerging markets and rapidly developing economies.

According to Gemfields, the last decade saw world record prices for rubies surpass those of colourless diamonds on a per carat basis. “Rubies, along with emeralds and sapphires, remain the most popular and valuable gem, highlighting their reputation as an inflation-defeating store of wealth and a guard against times of turbulence in global financial markets,” the miner said.

Gemfields added that the growth outlook for rubies remains stable as Covid-19 vaccination programmes progress globally. “We should have a better picture of the market outlook by March 2021,” it continued.

Ressigeac of GemCloud said production levels will slowly dip in the coming decades while prices will continue to soar.

Phillips’ Thompson added, “One can posit that prices for unheated Burmese rubies will continue to increase. The colour red also has such significance in Asia, the fastest and largest driver of wealth.”

Chongjie, for his part, noted that the appetite for ruby will bode well for other red gemstones.

Bergman meanwhile pointed out that over 90 per cent of rubies available in the wholesale market have been treated to enhance their colour and/or clarity using a high-temperature heating process. He said Chinese consumers must be educated to become more open to this trade practice just as they have accepted clarity-enhanced emeralds.

Henning of Greenland Ruby said end-consumers will increasingly look for transparency in the supply chain. The first coloured gemstone mining company to become a member of the Responsible Jewellery Council, Greenland Ruby is committed to driving demand while fostering trust and transparency in the gemstone business by tracking and tracing its rubies from the mine to market, she noted. In 2020, the company launched a virtual showroom called RubyCloud™, a proprietary inventory management software developed by GemCloud.

KV Gem’s Belmont said sustainability issues in the areas of human and labour rights, the environment and corruption are gaining importance in the trade, encouraging ruby suppliers to become more traceable.

This article first appeared in the JNA March/ April 2021 issue.