With their refreshing pastel greens and effervescent tones, mint tourmalines embody optimism and a youthful vibe that are commanding attention in the global gemstone sector.

Coloured gemstone traders are upbeat about prospects for mint tourmalines, thanks to these stones’ invigorating colour, size and affordability.

According to Josh Saltzman of lapidarist Nomad’s, tourmalines bearing a cool, mint colour have been gaining steam in the market since the company started operating about 20 years ago.

In the mid-2000s, a deposit in the Laghman province of Afghanistan became a historical and important source of mint tourmalines, placing these beloved green gems in the international spotlight.

US-based tourmaline expert Farooq Hashmi of Intimate Gems revealed that this area is still being mined today although mint tourmalines are occasionally found in numerous other locations in Africa.

“This vibrant mint green was initially referred to as ‘seafoam.’ In Pakistan, they even call it ‘emerald colour.’ This electric mint green became the colour standard for high quality and value,” said Hashmi. Navneet Agarwal of Navneet Gems & Minerals in Thailand noted that the popularity of mint tourmalines was further bolstered by the recent discovery of the new Congo tourmaline mine in 2018.

Tourmalines are currently mined in Afghanistan, Congo, Namibia, Nigeria, Mozambique, Brazil and even California. Still, the most sought-after mint tourmalines with “incredible primary body colour and better-balanced modifying colours” come from Afghanistan, said Peter Nelson, general manager of Nazo Anna. “Tourmaline crystals can also grow quite large and clean, allowing for truly exceptional gems to be cut from them,” he added.

Mint appeal

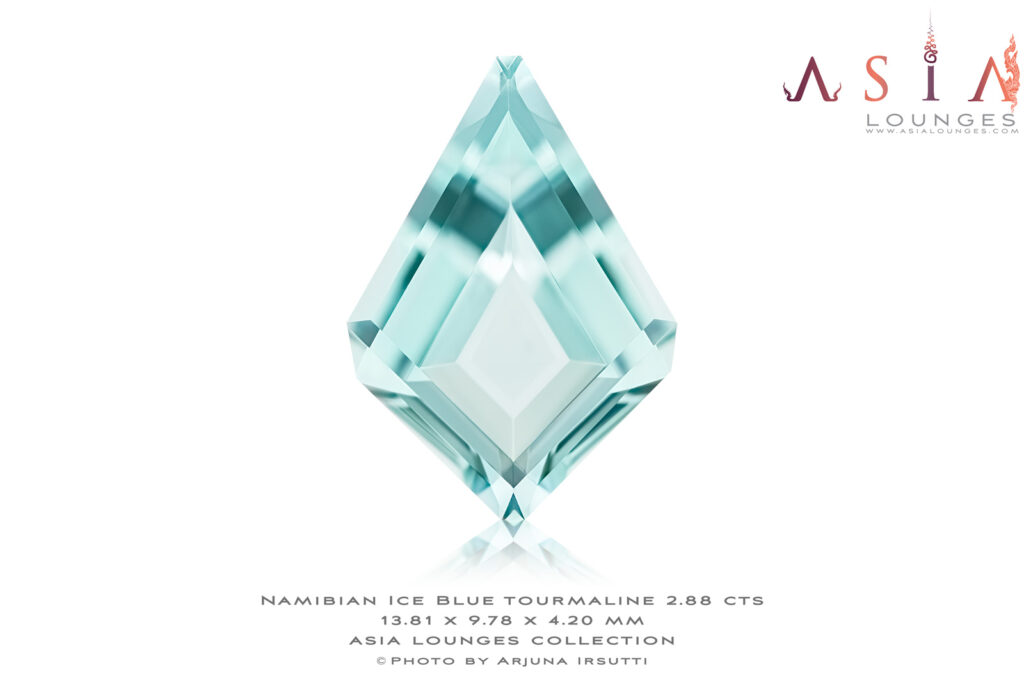

Mint is a widely used term in the trade that refers to a certain colour range – from neon, light-toned green to bluish green with a touch of yellow.

“Mint tourmalines in the pastel range are so attractive to us today because they remind us of the colour of candies from our childhood,” said gem dealer and bespoke jeweller Simon Dussart of Asia Lounges in Thailand. He added that luxury houses like Hermès and Kenzo, to name a few, also helped boost consumer interest in bright colours such as minty green, which figures prominently in their fabric collections.

Nelson of Nazo Anna explained that mint colours are particularly attractive to those who want to infuse vitality and youthfulness in their jewellery choices.

Demand and supply

Demand for this gem continues to be robust amid the Covid-19 pandemic due to its rarity. “The market’s appetite for mint tourmalines has never waned. Covid-19 has constricted the ability to travel and sell stones; not the desire to buy them. Even now, we still see movement in fine colours,” said Saltzman of Nomad’s.

Nelson said clients interested in exceptional stones started buying again after the initial shock from the pandemic had abated.

According to Asraf Sultan of Right Gems Supplier in Hong Kong, rising prices of indicolite and lagoon tourmaline made mint tourmalines a great alternative. Mint tourmalines from Afghanistan and Brazil are much favoured for their vivid and highly saturated colour while gems from Congo are lighter in colour.

Mint tourmalines from Afghanistan and Brazil are also twice as expensive as their counterparts from Congo.

Agarwal of Navneet sees strong sales in the 3-carat to the 20-carat range, adding that larger sizes are not moving as much during the pandemic. While smaller mining activities are taking place in Congo, production is not enough to meet current demand.

Navneet’s major markets for mint tourmalines are the US, UK and Europe, followed by Hong Kong and Singapore. Mint tourmalines also have a following among Chinese buyers.

Saltzman said mint tourmalines are popular in its main markets such as the US, Europe and Asia.

Production of fine materials however remains intermittent and confined to a few mines. Saltzman explained that a parcel of fine rough mint tourmaline is rarely seen nowadays.“

Currently, there is material coming out of Congo and Nigeria, but most of it is of commercial quality and not up to Nomad’s standards,” he continued.

Hahsmi noted that Nigeria produces fine materials that can sometimes rival those from Afghanistan, but production is also low.

Suhail Salahudeen of Star Lanka Co Ltd agreed that gem-quality mint tourmalines have become scarce while commercial-grade stones are abundant.

Top-quality mint tourmalines command premium prices. For instance, 1-carat stones from Congo can sell for anywhere between US$100 to US$500 per carat while fine-quality stones could go for US$1,000 per carat.

Colour is the primary price determinant for mint tourmalines, followed by clarity. With most varieties of tourmaline being of high clarity, there is little tolerance for glaring inclusions, according to Nelson.

Saltzman said every range of mint appeals to different consumers. “Some prefer a lighter tone; others like it more saturated. The main consideration is a subtle yellow secondary colour. The more yellow secondary hue and/or more grey cast, the less desirable the stone,” he noted. Origin is only next to colour and clarity.

For Dussart of Asia Lounges, antique cushion cuts are preferred by his customers. Kite shapes are also rising in popularity. Mint tourmalines above 10 carats are favoured by female consumers aged 45 to 55 years while younger women aged 35 years and below opt for 3-carat to 5-carat stones.

Nazo Anna has direct connections with tourmaline mines in Afghanistan, revealed Nelson. His clients include jewellers, manufacturers and private collectors. Melee or even stones of up to 7 carats are used for earrings and rings while 10-carat to 20-carat gems are usually set in pendants.

Mint tourmaline jewellery

Singaporean jeweller Madly Gems is a fan of mint tourmalines. “It’s bright, refreshing and more affordable in big sizes compared to light green emerald or mint garnet,” said Sabrina Leong of Madly Gems. The jeweller described the mint tourmaline’s bright hue as “very wearable and easy-breezy” compared to more vivid tones. “Most clients don’t place too much importance on origin but Afghanistan and Congo mint tourmalines look completely different, so it’s down to the client’s colour preference,” she added.

Los Angeles-based jewellery designer Erica Courtney regularly features mint tourmalines in her bespoke creations. “I love how well the minty green pairs with other tourmalines in my gemstone palette like Paraiba and canary tourmalines. Mint tourmaline also looks gorgeous on its own,” she remarked.

Courtney said that origin comes into play when it’s instrumental in the jewellery piece’s story or when it affects the price. “Our clients are collectors of beauty who are looking for jewellery pieces set with the most exceptional gems, so colour and clarity are both important,” she added.

Bright future

Opportunities still abound for mint tourmaline traders amid uncertainties. A tight supply of gem-quality stones coupled with soaring demand for top-range pieces will likely push prices up, noted Dussart.

According to Sultan, now is a great time to invest in mint tourmalines as prices are stable. Nelson meanwhile cited strong potential for designers to create truly unique pieces and for brands to develop distinctive jewellery collections using mint tourmalines.

Mint-green hues are not commonly seen in other gemstones – even with sapphires in the minty green range, which are not as big, clean or bright, added Agarwal. Salahudeen, for his part, is bullish about prospects for mint tourmalines in Asia, adding that Chinese buyers will continue to follow colour trends in the west. As such, he expects mint tourmalines to attract more attention in the market.

This article first appeared in the JNA January 2021 Issue.