What does Tokenization and NFT’s mean for the gems & jewellery world?

Blockchain technology and cryptocurrencies are leading the way with disruptive innovations affecting all business sectors globally. As the world might shift towards a decentralised digital economy, new and unexpected blockchain solutions for the gems and jewellery industry are also rising. Start up companies and investment projects have emerged in recent years, introducing blockchain solutions to commoditize precious gems and diamonds as an investment, known as asset-backed cryptocurrency. Blockchain pioneers believe that tokenization may offer a secure and efficient means of investing in diamonds, without the need to purchase the actual gem. Companies like Diamond Standard, D1 Coin, Altcoinomy, and GemBit have integrated blockchain technology in different ways to help revolutionise the trading of diamonds and gemstones through “tokenization.” Like a stock exchange, tokenization essentially allows token holders to trade co-ownership shares of a gemstone on the Ethereum blockchain.

Jacques Voorhees, diamond industry expert and CEO of Icecap Diamonds noted that the global pandemic has contributed to the rise of gem tokenization, which has forced the world to embrace digital interactions and to seek new alternative markets. Tim Denning of Bonas Group explained that this trend is simply an evolutionary step in the industry trying to monetize diamonds as a store of wealth.

The “tokenization” of gemstones and diamonds can be divided into two types: fungible (such as the standard ERC20 token), and non-fungible (NFT ERC721 token). A fungible token is one where every iteration of it is identical, like every bitcoin token is identical to every other bitcoin token. Diamond Standard is using regular tokenization to create a fungible product (a “diamond” coin), each made up of collections of five or six individual diamonds encased in a package.

Proud Limpongpan, Chief Strategy Office for Zipmex Thailand, Asia’s leading crypto assets trading platform, explains that the aim of using blockchain in tokenization is to break down barriers of entry, ensure assets’ authenticity and to eliminate fraud. “It’s basically the democratization of investment. You can invest in the same thing Elon Musk is investing in without having to be as rich as Elon. It started off with digital assets and has now extended to the physical realm.”

NFT’s explained

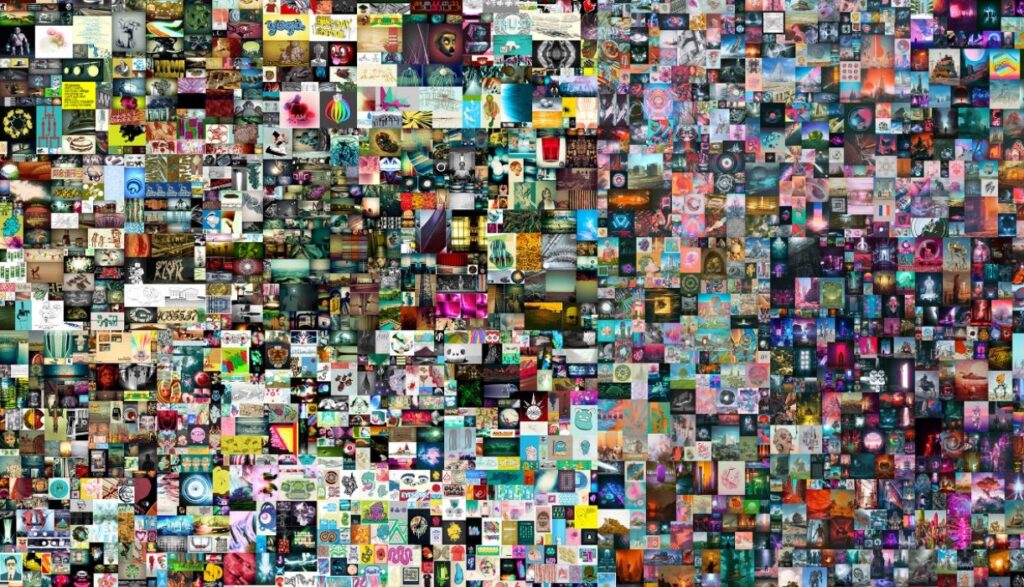

There has been a vast explosion of interest in NFT’s recently, partially sparked by Christie’s sale of the $69m digital art NFT. Chilean artist Sebastian Errazuriz has also capitalised on the NFT craze by creating the world’s first crypto gems with Digital Diamond Co. The artist sells digital diamonds at the price of real diamonds, presenting an intriguing value proposition that challenges today’s diamond landscape. The question is would intangible assets like digital diamonds have a future alongside real diamonds?

This strikingly creative idea has been met with criticism. “Diamond backed tokens are quite different to the digital images being sold with NFT’s. I commend the NFTDiamond.co team for its creativity and humour, but non-real diamonds aren’t diamonds. They are at best pictures of diamonds. They are no more relevant to the diamond industry than a deck of playing cards with diamonds on some of them,” said Voorhees.

In July 2021, Dubai-based startup company Icecap Diamonds broke out of the “intangible” space, and applied NFT tokenization to very tangible products like natural diamonds. Icecap Diamond’s aim is to solve stones’ lack of fungibility by offering investment-grade diamonds via NFT “token” technology. Each NFT token represents a specific item stored in an insured vault and tokens representing their ownership can be traded on NFT trading platforms such as OpenSea.io. Tokens may be bought, sold or redeemed in exchange for the actual diamond at any time. According to Voorhees, very few investment vehicles for diamonds have truly succeeded in the past due to illiquidity, price opaqueness and large bid-ask spreads. “Icecap has eliminated all three problems. We believe these have been holding back what would otherwise be a $10 billion+ demand for diamonds from the financial sector, for purposes of hard-asset diversification.”

Some are skeptical of how NFTs could be adopted in the gems and jewellery world. Rami Baron, Founder of the Young Diamantaires, an initiative of the World Federation of Diamond Bourses and CEO of Q Report Jewellery Insurance said “NFTs are moving into an interesting space with art, and clearly diamonds or any asset is open to this space. However a buyer is looking for security and confidence in the investment. As most of these are new and untested financial vehicles, buying a NFT could well be a great tool in the future, but the jury is out in the general diamond community.”

According to Limpongpan there is a tendency in the market to blur regular tokenization and NFT’s, however, they involve different goals. Regular tokenization issues a fungible coin that represents a share or percentage of a gemstone on the Ethereum blockchain, whereas NFTs are specifically one of a kind. “Tokenizing a gemstone means you are allowing more than one person to buy and sell aspects of this gemstone – it’s as if you’re breaking it into smaller pieces so that anyone can invest with as little as $1. NFT is usually when the whole gemstone is attached to 1 token, and this token is not only traceable but also unique” said Limpongpan.

“With NFTs, sellers can designate gems and diamonds into a scarcity based hierarchy to represent the value they might have in the physical world. On top of that, both buyers and sellers can personalize the NFT through smart contracts and reflect the essence of true ownership.”

Voorhees added that “each NFT is discretely different, like a social security number, a fingerprint, or a snowflake. The NFT is just a “warehouse receipt” from the company that is storing the tangible product for you. Therefore, they are ideal for representing the ownership of something non-fungible, like a diamond.”

He explained “gemstones are very small, difficult-to-track items, and blockchain technology and tokenization add real value to our industry. This makes the product more attractive, as it has the potential of adding transparency and integrity to the process.”

As the market for cryptocurrencies and non-fungible tokens surges, there is an opportunity to attract members of the crypto world to purchase diamonds and jewellery. “An increase in sales channels and market integration could result in better liquidity,” said Limpongpan. “The supply of diamond is limited and remains the same regardless of whether it is turned into an NFT or not. What changes is the marketplace integration as people can now purchase diamonds from both traditional jewellers and via a NFT platform.”

Limpongpan explained that “Buyers will benefit from increased choices and lower cost of “holding”, ease of reselling, as well as safety – in short, all things NFT. It is easy to store and trace, hard to lose.”

Business Opportunities and Growth

The trend of gem tokenization and NFT diamonds depends on how successful the first few projects are, stated Limpongpang. “Projects can pertain to certain ecosystems or geographies only, they don’t have to be globally adopted. The only way to find out is to actually launch an NFT in the market. There’s tremendous potential in this area and I personally think it can stand the test of time. It probably will not be mainstream, but since when has gemstones or diamond investment been mainstream anyway?”

Although many people are largely unaware of the concept of gem tokenization, industry players like Icecap Diamonds are paving the way for mainstream adoption. “Ultimately, the technology of tokenization could one day be looked back upon as no less important a development as laboratory grading certificates, or the Internet itself,” said Voorhees. Icecap Diamonds recently announced the launch of high-end diamond and jewellery collectibles, including a US$3 million intense red diamond as its first offering.

While there may be mutual benefits for investors and sellers, gem tokenization also comes with a set of challenges. Baron believes the grading of diamonds is nonetheless still driven by subjective opinion, causing the same lack of objectivity in diamond pricing. “This also becomes even more problematic if you are adding another component as a new investment tool like crypto.” In his view, the diamond community is very sceptical at this point to recommend this type of investment vehicle.

Tokenization enables the creation of a new financial system, one that is more democratic and more efficient than anything we have seen before. The concept of gem tokenization and NFTs is rapidly changing and still in its infancy stage. While it may be too early to forecast the benefits and returns of this burgeoning trend, only time will tell if crypto gemstone investments can flourish in years to come.

Article published on Adorn Insight.